Michael Burry Bought The Dip In New York Community Bancorp.; And So Did I (NYSE:NYCB) |

您所在的位置:网站首页 › prof michael baldea › Michael Burry Bought The Dip In New York Community Bancorp.; And So Did I (NYSE:NYCB) |

Michael Burry Bought The Dip In New York Community Bancorp.; And So Did I (NYSE:NYCB)

|

Astrid Stawiarz Michael Burry became famous betting against the banks before the great financial crisis, which reportedly netted his hedge fund close to $4 billion in earnings. Now, in context of the regional bank crisis, the famed value investor is making headlines again: But this time he is not betting against the banks, but on them. According to the latest 13F filing for his firm Scion Asset Management, which has been released on Monday 15th of May, Dr. Burry bought the dip in the following bank stocks: New York Community Bancorp. (NYSE:NYCB) Western Alliance (WAL) PacWest (PACW) First Republic Bank (FRC) Wells Fargo (WFC) Huntington Bancshares (HBAN)The largest of these new portfolio additions in the banking sector (Burry also bought Alibaba (BABA) and JD (JD)), is New York Community Bancorp, a bank holding company currently trading at a ridiculously attractive FWD P/E of ∼2.9 and a P/B of ∼0.75. In addition to the cheap valuation, NYCB is also interesting because it bought some (arguably) deeply undervalued assets from the failed competitor Signature Bank. Personally, I value NYCB at a $20.94/ share target price; and as a consequence of valuation, I assign a 'Strong Buy' rating. For reference, despite the 'bank crisis', NYCB stock has outperformed the broad market: YTD, the bank's shares are up approximately 26%, as compared to a gain of about 10% for the S&P 500 (SP500).

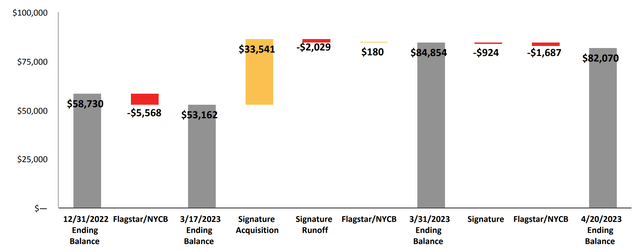

Seeking Alpha About NYCB And The Signature Bank AcquisitionNew York Community Bancorp, Inc. is a U.S. based holding company with assets totaling $124 billion. The bank operates two subsidiaries, namely New York Community Bank and New York Commercial Bank. With a network of close to 450 branches and a total deposit base of approximately $82 billion, NYCB is ranked among the largest 25 banks in the U.S. NYCB made headlines in late March, when the company announced to buy (arguably) undervalued assets from failed competitor Signature Bank. As outlined in the deal, NYCB acquired "substantially all" of Signature Bank's deposits, 40 of Signature’s branches, and over one-third of Signature Bank's assets, which includes loans totaling nearly $13 billion for 80 cents on the dollar. Going into Q1 2023 reporting, one of NYCB investors' key question related to the bank's ability to retain the acquired deposit. And the retention proved clearly resilient: Of the $34 billion in deposits acquired from Signature Bank, only $2.95 billion, equivalent to ∼9% of the Signature deposits, had been withdrawn as of April 20. Consequently, an impressive $31 billion in deposits remains on NYCB's balance sheet, highlighting customers' trust in the NYCB franchise.

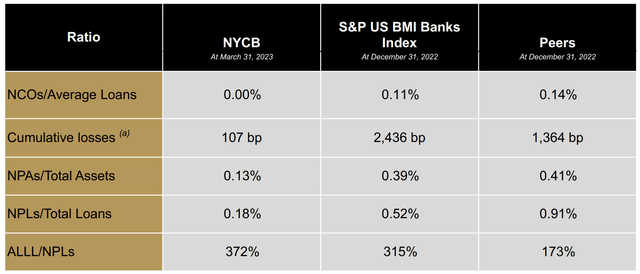

NYCB Q1 reporting Significant Profitability Potential For The Combined Bank Entity A Note on Net Interest Margin (NIM)According to NYCB's earnings release for the January quarter 2023, the combined entity's net interest margin showed a significant improvement versus the same period in 2021, expanding by about 32 basis points to ∼2.60%. This performance exceeded street consensus expectations anchored around 2.5-2.55%, and highlights the value accreditive impact of the SBNY acquisition on NII. Although similar to other banks NYCB noted some funding challenges during the quarter, as the cost of funds increased by approximately 40 basis points to ∼2.30%, management voiced confidence that further expansion in the bank's NIM is probable, with the metric likely expanding to 2.80% by end of Q2, and close to 3% by end of 2023. Notably, relating to the 'funding challenges', I would like to point out that NYCB did not need to rely on wholesale borrowings during the quarter, as the bank had sufficient cash to buffer movements of deposits (close to $42 billion readily available liquidity). A Note on CostsIn context of the Q1 2023 report, NYCB also added color on the combined entity's expenses. According to management guidance, NYCB standalone expenses for the year 2023 will likely range between $1.3 billion and $1.4 billion. On top of this, management expressed confidence that they can achieve a reduction of approximately 50% in Signature's existing cost base, which amounts to around $860 million, which is broadly in line with the historical range of 35% to 50% cost savings that NYCB has typically realized from previous M&A activity. Accordingly, based on these projections, I estimate NYCB's annualized expenses for 2023E at approximately $1.8 billion to $2.0 billion. Strong Balance Sheet And Credit ProfileThe majority of NYCB's loan portfolio is dedicated to low-risk multi-family loans, primarily on non-luxury and rent-regulated buildings, which have historically proven to be quite impairment-resilient. In Q1 2023, the combined entity's non-performing loans amounted to $148 million, which represents a mere 0.13% of NYCB's total loan portfolio (NPAs/ Total Loans), and a decline of 4 basis points from the previous quarter. Moreover, I would like to point out that the slight 10 basis points increase in NYCB's LLR/loans ratio, which is an indicator of the company's loan loss reserves in relation to its loan portfolio, is only logical given that the company acquired a significant portion of commercial loans, totaling $12 billion. And the 0.67% LLR/loans ratio is still super low.

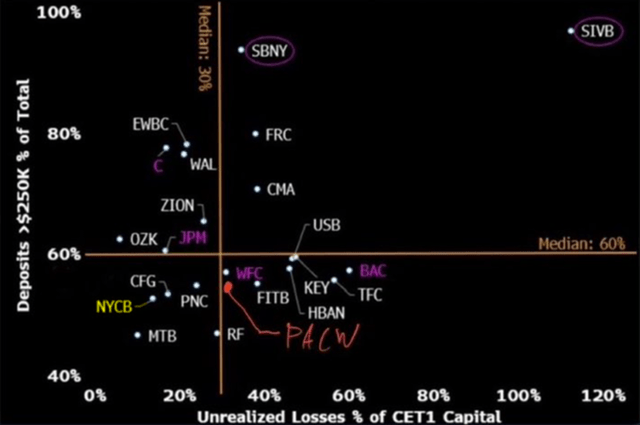

NYCB Q1 reporting As an additional argument that speaks in favor of NYCB's low risk profile, I would like to highlight a tweet from Michael Burry, who shared his analysis that as a function of insured deposits/ total deposits and a unrealized losses/ of CET1 capital, NYCB is outperforming almost all U.S. bank peers.

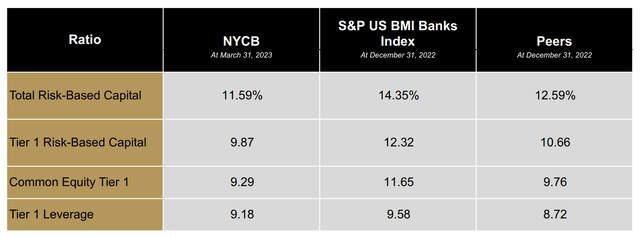

Michael Burry/ Twitter Below Benchmark CET1 Not ConcerningAs of late March 2023, NYCB's CET1 stood at 9.29%, which is below the S&P US BMI benchmark of 11.65%. However, there are three reasons why I consider NYCB's underperformance on CET1 not very concerning: First, NYCB owns a loan portfolio with lower risk compared to the majority of other banks (see almost non-existent credit impairment). Second, NYCB's earnings capacity resulting from the SBNY takeover should facilitate a quick rebuild of capital. And third, the regulators' approval of the NYCB's acquisition of SBNY indicates government endorsement of the combined entity, suggesting that the regulators are likely to extend support in case of any capital difficulties.

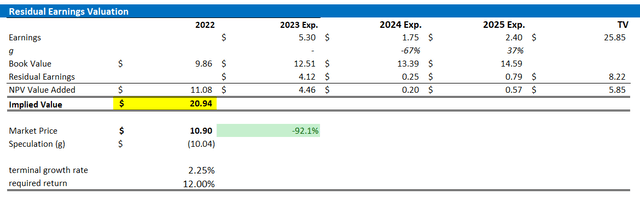

NYCB Q1 reporting Valuation: Residual EarningsTo derive a more precise estimate of a company's fair implied valuation, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business' discounted future earnings after capital charge. As per the CFA Institute: Conceptually, residual income is net income less a charge (deduction) for common shareholders' opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company's capital. With regard to my NYCB stock valuation model, I make the following assumptions: To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal 'till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, the analyst consensus is usually quite precise. To estimate the capital charge, I anchor on NYCB's cost of equity at ∼12%. For the terminal growth rate after 2025, I apply 2.25%, which I believe is a reasonable estimate post-2025 (approximately 0.5 - 1 percentage points above nominal GDP growth). Investors with different assumptions regarding NYCB's cost of capital and terminal growth may take reference from the sensitivity table enclosed.Given the above assumptions, I calculate a base-case target price for NYCB of about $20.94/share.

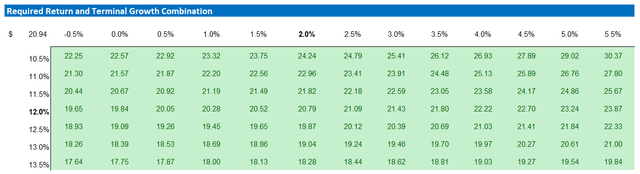

Company Financials; Author's EPS Estimates; Author's Calculation My base case projection for NYCB's target price implies material upside. However, it is crucial for investors to evaluate the risk and reward ratio of investing in a company based on a 'scenario' view. To assess different scenarios based on various assumptions, I have created a sensitivity table that analyzes NYCB's cost of equity and terminal growth rate. See below.

Company Financials; Author's EPS Estimates; Author's Calculation RisksIn my perspective, there appears to be an overabundance of caution prevailing in the market when it comes to certain bank stocks. However, I firmly believe that strategically calculated risks have the potential to yield substantial rewards in the long run. Nevertheless, it is crucial for investors to acknowledge that banks, including NYCB, inherently carry a higher level of tail risk due to the leverage involved in their balance sheets. It is important to note that recent developments have increased the possibility that equity holders of NYCB may face a complete loss of their investment. It is incumbent upon individual investors to carefully evaluate their risk tolerance and determine whether they are comfortable with the associated level of risk in this context. ConclusionDr. Michael Burry bought the dip in banks stocks and accumulated 850,000 shares in NYCB at $9.04/ share, for a total of about $7.7 million. I agree with his decision to load up on NYCB and in this article, I highlight key considerations regarding the bank's balance sheet and income statement. In context of strong fundamentals, the risk/ reward for buying NYCB at a FWD P/E of ∼2.9 and a P/B of ∼0.75 looks exceptionally attractive. As compared to the bank's intrinsic value, NYCB stock could be undervalued by about 100%. Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. |

【本文地址】